introduction

Low-Risk Investments: Building a Stable Income Without High Risk

Investing doesn’t always have to be risky, especially if your goal is to build a stable income. If you’re looking for low-risk investments that can offer reliable returns, there are plenty of options to consider. Whether you’re new to investing or you want to protect your capital while still earning, these options can help you achieve your financial goals without exposing you to unnecessary risk. In this post, we’ll take a closer look at the top low-risk investment options for building a steady income, explore their benefits, and discuss how to make the most of them.

Table of Contents

What Are Low-Risk Investments?

Low-risk investments are financial instruments that are less likely to lose value compared to high-risk assets such as stocks or commodities. These options are ideal for investors looking for consistent returns, without having to worry about large fluctuations in the market. While the returns may be more modest than higher-risk options, the trade-off is that you are more likely to preserve your capital and generate a steady income over time.

Popular Low-Risk Investment Options

Here are some of the best low-risk investments for building a stable income:

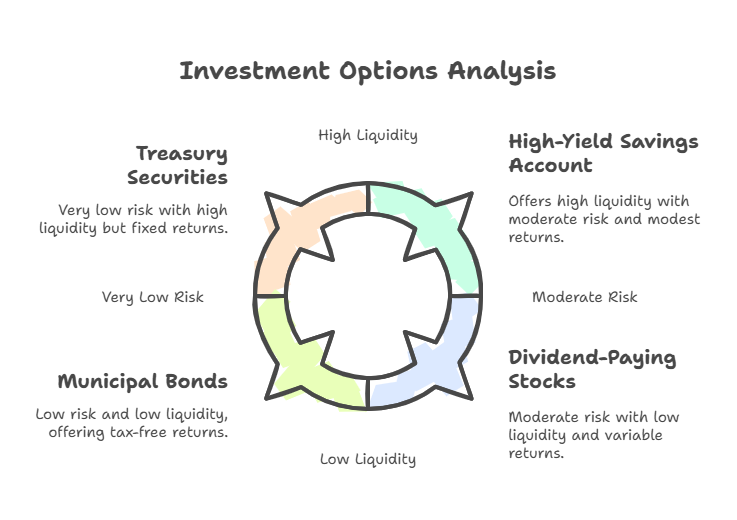

- High-Yield Savings Accounts (HYSA) A high-yield savings account is one of the safest ways to grow your money with minimal risk. These accounts offer higher interest rates than traditional savings accounts, allowing you to earn a reliable return. Ideal for short-term savings, HYSAs are liquid, meaning you can easily access your funds if needed. However, while the returns are guaranteed, they might not outpace inflation, making them a good option for emergency savings but not long-term wealth building.

- Certificates of Deposit (CDs) A certificate of deposit (CD) is a time deposit offered by banks. You agree to lock your money for a fixed period (usually ranging from a few months to several years) in exchange for a guaranteed return. CDs are low-risk because they are insured by the government up to certain limits. However, they come with limited liquidity since withdrawing your funds before the term ends can result in penalties.

- Treasury Securities Treasury securities, including Treasury bills, notes, and bonds, are backed by the U.S. government and are considered some of the safest investments available. These bonds offer fixed interest payments and are highly liquid, as they can be bought and sold in the secondary market. While they provide a stable income, their returns may not be as high as other investments, particularly during times of low-interest rates.

- Municipal Bonds Municipal bonds are debt securities issued by state or local governments. These bonds are considered low-risk, as they are backed by the issuing government. The major advantage of municipal bonds is that they often provide tax-free income, which can be especially beneficial for high-income earners. However, they may offer lower returns compared to other investments, and their liquidity can be limited.

- Dividend-Paying Stocks While stocks are generally considered higher risk, dividend-paying stocks can offer a steady stream of income with lower risk compared to non-dividend-paying stocks. Established companies with a long history of paying dividends are often a safer bet, making them a good option for building a stable income. However, the value of the stock can still fluctuate, so it’s important to select companies with a strong financial foundation.

Comparison of Low-Risk Investments

To help you decide which low-risk investment might be best for your goals, here’s a quick comparison of the options discussed above:

Key Insights for Low-Risk Investors

- Diversification Is Key Even within low-risk investments, diversification is important. Spreading your investments across different asset types can help minimize risk. For example, you might combine Treasury securities with dividend-paying stocks to achieve both safety and growth potential.

- Tax Considerations Be mindful of the tax implications of your investments. Some municipal bonds offer tax-free income, which can be beneficial depending on your tax bracket. On the other hand, interest from HYSAs and CDs is taxable, so be sure to factor that into your overall return.

- Managing Inflation While low-risk investments are safer, they may not always keep up with inflation. This means the purchasing power of your returns could decrease over time. To combat this, consider including some higher-risk investments in your portfolio if you’re looking for growth over the long term.

Conclusion: Building a Steady Income with Low-Risk Investments

Low-risk investments are an excellent option for building a stable income with minimal risk. By choosing the right mix of high-yield savings accounts, CDs, Treasury securities, municipal bonds, and dividend-paying stocks, you can create a well-rounded investment strategy that aligns with your financial goals and risk tolerance. Keep in mind that while low-risk investments provide more security, they may not deliver high returns. However, they can offer the peace of mind that comes with knowing your capital is protected while generating a steady income over time.

Pingback: Future Investment Trends: