introduction

Future Investment Trends: What’s Changing in 2025 and Beyond?

The investment world is evolving fast, and staying ahead of the curve is crucial. Whether you’re a seasoned investor or just getting started, understanding the trends shaping 2025 and beyond can help you make smarter investment decisions.

From AI-driven opportunities to the growing push for green energy investments, the investment landscape is shifting in exciting ways. But with change comes uncertainty—so where should you focus your investment strategy? In this guide, we’ll break down the key investment trends, compare emerging investment opportunities, and highlight insights that can help you navigate the future with confidence.

Let’s dive in!

Table of Contents

1. The AI Revolution: A Game-Changer for Investors

Key Investment Trends:

- AI investments are transforming industries, driving automation, and increasing efficiency.

- Investment opportunities in AI stocks, AI startups, and AI infrastructure are expanding.

- The demand for energy-efficient AI data centers is rising due to AI advancements.

Read more about AI investment opportunities here.

2. Green Energy & Sustainability: The Future of Power

Key Investment Trends:

- Renewable energy investments in solar energy and wind energy are experiencing rapid growth.

- Government policies are supporting green energy investments.

- Sustainable real estate investments are gaining traction as eco-friendly properties increase in demand.

Explore the economic potential of green investments.

3. Defense & Security: A Resurgent Investment Sector

Key Investment Trends:

- Rising global tensions are driving increased defense sector investments.

- Cybersecurity investments are seeing strong growth due to rising digital security threats.

- Military technology investments are expanding globally.

Read about Europe’s renewed defense investment focus.

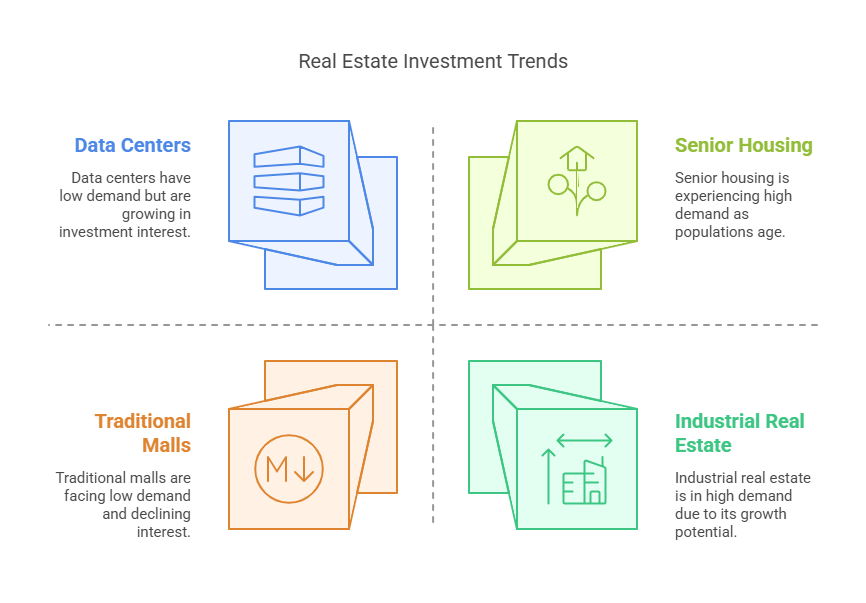

4. Real Estate Investments: Shifting Preferences in 2025

Key Investment Trends:

See the latest real estate investment shifts.

5. Emerging Markets: New Frontiers for Growth

Key Investment Trends:

- China’s economic stimulus investments are driving new investment opportunities.

- Emerging market investments offer high growth but come with higher risks.

- Investment diversification is key when investing in these regions.

Discover why emerging market investments are attracting investors.

6. Alternative Investments: Expanding Your Portfolio

Key Investment Trends:

- Radiopharmaceutical investments are growing in the healthcare investment sector.

- AI and blockchain investments are merging to create new investment possibilities.

- Investors are diversifying beyond traditional asset classes.

Learn about the rise of radiopharmaceutical investments.

7. REITs: Real Estate Investing Without Property Ownership

Key Investment Trends:

- REIT investments offer real estate investment exposure without direct property ownership.

- Mortgage REIT investments provide high-yield potential but are interest rate-sensitive.

- Data center REIT investments are thriving due to cloud computing and AI growth.

Read a full guide on REIT investments.

8. The Role of Politics in Investment Decisions

Key Investment Trends:

- Market sentiment shifts based on election outcomes and policy changes.

- Trade policy investments and tariff impacts create both investment risks and opportunities.

- Political events can heavily influence short-term investment decisions.

Find out how politics can impact your investment portfolio.

9. The Power of Investment Diversification

Key Investment Trends:

- A well-balanced investment portfolio helps mitigate investment risks and optimize returns.

- Combining stocks, bonds, and alternative investments improves investment stability.

- Staying informed is crucial for making smart investment decisions.

Explore Morgan Stanley’s insights on investment diversification.

Final Investment Thoughts

2025 is set to be a dynamic year for investors, with emerging investment sectors, shifting investment trends, and evolving investment risks. The key to success? Staying informed, diversifying wisely, and adapting to market changes.